Dream Unlocked!

Congratulations! Dream house unlocked! Another goal conquered. Oh that delightful feeling of finally getting yourself the house and lot that you’ve worked hard for. That sense of fulfilment and excitement for a fresh start. Your creativity and imagination of how you want your home to be is now hyped up and a lot of exciting work still needs to be done. But hold those thoughts for a moment and remember to do a few more things after the purchase of your dream home.

What do I do next?

Understanding your obligations and knowing the necessary things to do next will help you to be free of worry and your property to be more secured and protected. Don’t get intimidated by the processes that you need to go through, everything is doable. Thanks to the internet and agencies for providing updated information and processes so you won’t miss anything that you need to do next.

What are my responsibilities?

1. Paying Real Property Tax

Before anything else, it’s practical that we understand what we are paying for. Real Property Tax (RPT) is a type of tax in the Philippines which is imposed on real properties such as land, building, machinery, and other improvements. It is under the Local Government Code of 1991 or the Philippine Republic Act 7160 stating that property owners are obliged to pay Real Property Tax (RPT) annually .The homeowner is required to declare the property’s value through an assessment.

Real property tax rates varies depending on the location. If your property is situated in the province, the basic rate prescribed based on the assessed value of the real property is 1%. On the other hand, if your property is located at a city or municipality within Metro Manila area, the rate is 2%. Aside from the basic real property tax, the following can be likewise imposed:

- 1% of the assessed value of the real property for the Special Education Fund (SEF)

- 5% of the assessed value of the real property tax for the Ad valorem tax on idle lands

- Special assessment for the recovery of at least 60% of public improvements which benefits the real property

As a taxpayer, you also have the option to pay annually or quarterly by dividing it in four equal payments based on the schedule below:

- 1st quarter: on or before March 31

- 2nd quarter: on or before June 30

- 3rd quarter: on or before September 30

- 4th quarter: on or before December 31

Note that those who pay the full amount due in January are usually given up to 20% tax discount, depending on the local government unit’s allowed rate, where the property is situated. As much as it is a huge savings for the homeowner, it is also beneficial to pay on time to avoid penalties.

Where can you pay the RPT? Just go to the local government unit where the real property is located and pay over-the-counter at the Treasurer’s office. You will secure an order of payment (OP) from the Assessor’s Office then proceed to the realty tax section. Present the OP with the new tax declaration since it’s a newly transferred property. The collection officer will compute the tax that you will be paying. As easy as it sounds, you’re already done. Some cities and municipalities also accept payment via online payments if you want your transaction to be a breeze.

What if you failed to pay on time? Penalties will be imposed on late payments. Penalty is at 2% interest per month on the unpaid amount maximum of 72% if still unpaid for 36 months or 3 years. If you failed to pay your real property tax, the taxing authority has the power to sell your home or its lien on the property in order to satisfy your debt. To avoid this, it is always better to pay on time.

Want to read more of this? You can also visit taxacctgcenter.ph for more useful and practical information on taxes. Similarly, you can find a sample computation at pinoymoneytalk.com.

2. Mortgage Redemption Insurance

If you took a loan to buy your home, may it be an affordable home or a high-end condominium, you will be required to have a Mortgage Redemption Insurance. This serves as a financial protection to all the parties involved, especially the homeowner and their families. In unfortunate events when the borrower dies or when he is deemed totally disabled, the life insurance of the buyer secures the loan. This helps the family as it will be a burden for the other household members to pay off the unpaid portion of the loan, especially when the borrower is the sole breadwinner of the family. The remaining unpaid amount will be covered by the MRI.

How to apply for an MRI? It is made easy by the institutions that lend money to borrowers by incorporating it as part of the application process for a home loan. You only have to pay for the insurance premium once as it will cover the entire term of the loan.

Read more about this and other helpful features in imoney.ph to make most of your money by providing you a trusted financial comparisons of a wide range of products in the market today. Also visit carousell.ph for tips options to pay for your dream house. It is also a reliable avenue to find affordable house and lots like Lessandra homes.

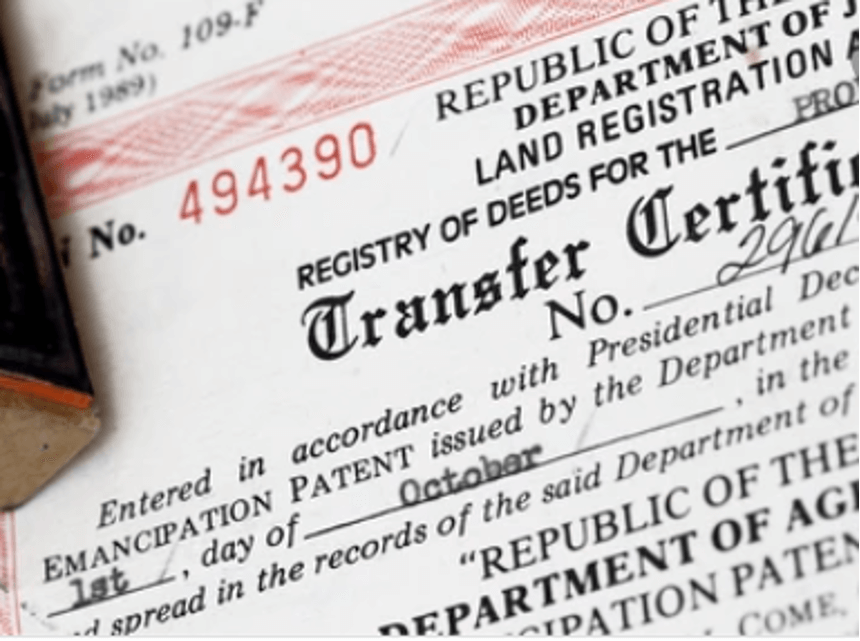

3. Secure the Property’s Land Title

A Certificate of Land Title is your ultimate proof of ownership of the property. It will be registered from the seller’s name to the buyer’s. With it registered under your name, you will be able to enjoy the maximum value of the property, such as using it as collateral for loan applications. This will also serve as protection from the risk of fraudulent activities against you and the property, such as creating a fake Land Title for it and being sold without your knowledge.

Unlike paying for real property tax and getting a mortgage redemption insurance, getting a Transfer Certificate of Title in the Philippines can be time-consuming, it can take two to four months to process and can be tedious, too. However, this is the most important and fulfilling factor of the acquisition. Imagine holding that piece of paper as proof of ownership of the house and lot under your name. The long wait will really pay off.

It is very important to execute the transfer of title as immediate as possible to secure your ownership, avoid penalties for late transfer because of leaving the property untitled, and to avoid legal conflicting claims and ownership disputes in the future.

How to process the transfer? Follow the steps below and note some important points to make the transfer convenient and hassle-free.

- If you are not going to process the transfer yourself, make sure to hire a legitimate, registered, and trustworthy expert to process it on your behalf. This will give you confidence as the transaction carries on

- The following requirements should be prepared:

a. Original copy plus 2 photocopies of the notarized Deed of Absolute Sale (DAS)

b. Owner’s duplicate copy plus 2 photocopies of the Transfer Certificate of Title (TCT) or the Condominium Certificate of Title (CCT) applicable to condominium units

c. Certified True Copies plus two photocopies of the latest Tax Declaration for land and improvement of the real property. If the property sold is a vacant lot or no improvements have been made on it, a Sworn Declaration of No Improvement by at least one of the transferees or the Certificate of No Improvement issued by the Municipal or City assessor

d. Tax Identification Number (TIN) of both the Seller and Buyer

Additional requirements (if applicable):

a. Special Power of Attorney (SPA), if the person signing on the document is not the owner and only as a representative is appearing on the TCT or CCT

b. If the SPA is executed abroad, a Certification of the Philippine Consulate in needed

c. The Location plan or vicinity map when zonal value cannot readily be determined from the documents being submitted

d. For documents required in case of mortgage, judicial or extra-judicial settlement of estate, judicial and extra-judicial foreclosure of mortgage, consolidation of ownership, execution sale and condominium project, please refer to Documentary Requirements for the Registration of Real Property with the Register of Deeds

It will also be helpful if you can secure a copy of the requirements in your local office for possible other requirements as may be required by law, rulings, regulations, or other issuances. - Go to the Bureau if Internal Revenue (BIR) for the computation of Capital Gains Tax (CGT) and Documentary Stamp Tax (DST). After getting the computation, you will be signing and filling out three copies of each - BIR Form 1706 for the CGT and BIR Form 2000 for the DST. Then you will be asked to pay the CGT and DST at an authorized agent bank (AAB)

- Go to the Authorized Agent Bank (AAB) and make a cash payment for both the CGT and DST. Make sure to get a copy of the stamped receipt of payment that you have made.

- Go back to the BIR to return all the documents together with the stamped receipt of payment from the AAB. You will then be given a claim slip indicating the date when you can claim the Certificate Authorizing Registration (CAR). This will be required by the Registry of Deeds for registration of the title and the issuance of a new Owner’s Duplicate Original Copy of the TCT or CCT. The following documents will be released within five (5) days from the date you submitted the documentary requirements.

a. Original copy of the Deed of Absolute Sale stamped received by the BIR

b. Owner’s Duplicate Copy of the TCT or the CCT

c. Original Copies of the BIR Form 1706 (CGT) and Form 2000 (DST) stamped received by the BIR

d. Copies of the Tax Declaration for land and improvement - Pay the Transfer Fee at the Local Treasurer’s Office. You need to present the following documents to secure a copy of the Tax Clearance:

a. Original and one photocopy of the Deed of Absolute Sale

b. Photocopy of the Tax Declaration

c. Official Receipt of Payment of Real Property Tax and Special Education Fund Tax (SEF) for the current year - Go to the Registry of Deeds (ROD) to receive the new Owner’s Duplicate Copy of the TCT or CCT in your name. You have to pay a registration fee and submit the required documents. Within five (5) days, a new Owner’s Duplicate Copy of the TCT or CCT will be released to you.

- Go to the Local Assessor’s

Office for the issuance of the Tax Declaration under your name by submitting the

requirements listed below:

a. Photocopy of following:

Deed of Absolute Sale

TCT or the CCT

CAR

Transfer Tax Receipt

Latest Tax Receipt or Tax Clearance

b. Some local assessor’s offices may require these additional documents:

a. Subdivision Plan, if lot is subdivided

b. Colored photos of the house, lot, or condominium unit

You may also check the list of requirements at myproperty.ph. Not only does it provide a comprehensive list of processes but also relevant and up-to-date real estate information useful for homebuyers or tenants searching for affordable house and lot in the Philippines.

Tips to remember

A new home comes with new responsibilities. Be sure to, at all times, make updated payments to avoid penalties and problems. This way, you are protecting the home that you’ve dreamed and worked hard for. It is always a good move to immediately process the necessary things to be done. Don’t get intimidated by the documents that you need to get and the processes that you need to go through. There are tons of resources that you can get information from to lighten the weight of the process. If you don’t have the time to do everything, remember to get help from proven and trustworthy people to help you with all your transactions to save you from preventable worries. Just like finding your perfect home among all the affordable house and lots for sale, be patient and keen. Lastly, enjoy the experience and make more lasting memories with your new home.

Sources:

https://taxacctgcenter.ph/features-of-real-property-taxation-in-the-philippines/#:~:text=Real%20property%20tax%20rates%20at,municipality%20within%20Metro%20Manila%20area

https://www.imoney.ph/articles/mri-a-home-buyers-must-have/

https://www.myproperty.ph/journal/2019/02/13/a-step-by-step-guide-to-land-title-transferring-in-the-philippines-infographic/

https://www.pinoymoneytalk.com/costs-taxes-buying-property/

https://blog.carousell.ph/property/tips-home-buyer-first-time/